May 7, 2019 by Frank Wouters and Ad van Wijk Leave a Comment

Electricity has well known limitations, mainly for bulk and long-range transport, industrial processes requiring high temperature heat, and the chemicals industry. To entirely replace fossil fuels we need hydrogen, say Frank Wouters and Prof. Dr. Ad van Wijk. It has an energy density comparable to hydrocarbons. There’s more: Europe’s electric grid can’t cope with 100% electrification, yet hydrogen would use the existing gas pipe networks. The authors lay out a plan to deliver 50% of Europe’s energy from hydrogen by 2050. Done rapidly at scale, hydrogen would soon be as cheap as gas. It will also make Europe the hydrogen market leader: what technologies Europe (or anywhere!) masters first, it can sell to the rest of the world hungry for clean energy solutions.

Electrification is one of the megatrends in the ongoing energy transition. Since 2011, the annual addition of renewable electricity capacity has outpaced the addition of coal, gas, oil and nuclear power plants combined, and this trend is continuing. Due to the recent exponential growth curve and associated cost reduction, solar and wind power on good locations are now often the lowest cost option, with production cost of bulk solar electricity in the sunbelt soon approaching the 1 $ct/kWh mark. However, electricity has limitations in industrial processes requiring high temperature heat, the chemicals industry or in bulk and long-range transport.

Green hydrogen made from renewable electricity and water will play a crucial role in our decarbonised future economy, as shown in many recent scenarios. In a system soon dominated by variable renewables such as solar and wind, hydrogen links electricity with industrial heat, materials such as steel and fertiliser, space heating, and transport fuels. Furthermore, hydrogen can be seasonally stored and can be transported cost-effectively over long distances, to a large extent using existing natural gas infrastructure. Green hydrogen in combination with green electricity has the potential to entirely replace hydrocarbons.

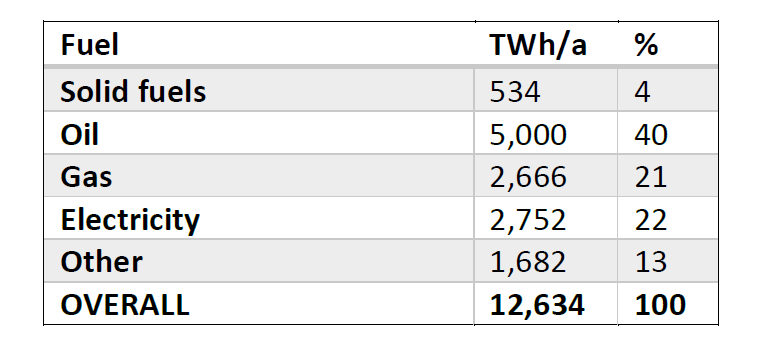

Energy demand in Europe

Europe is a net energy importer, with 54% of the 2016 energy needs met by imports,consisting of petroleum products, natural gas and solid fuels. Although Europe is working ambitiously to become less dependent on energy imports, it is unlikely that Europe can become entirely energy self-sufficient. Most scenarios, including BP’s Energy Outlook 2019[1] indicate that Europe shall remain a net importer of energy until mid-century and beyond.

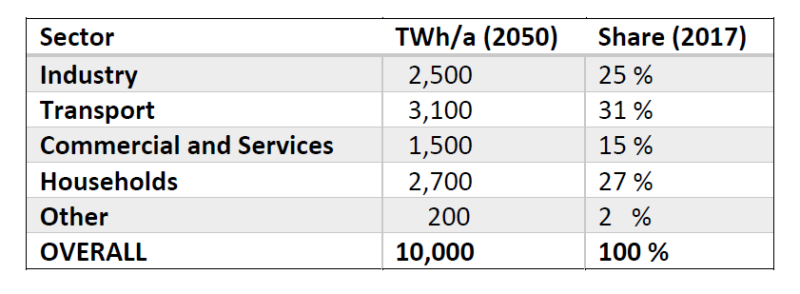

Several recent scenarios exist for Europe’s energy system in 2050, including Shell’s Sky Scenario[2], The Hydrogen Roadmap for Europe[3], DNV-GL’s Energy Transition Outlook 2018[4] and the “Global Energy System based on 100% Renewable Energy – Power Sector” by the Lappeenranta University of Technology (LUT) and the Energy Watch Group (EWG) [5]. But also, several renewable energy industry associations have assessed the role of renewable energy in the European energy mix by 2050, among which are EWEA[6] and GWEC[7]. Analysing and comparing these scenarios, an estimated 2,000 GW of solar and 650 GW of wind energy capacity is required to decarbonise Europe’s electricity sector by 2050, generating roughly 3,000 TWh of solar energy and 2,000 TWh of wind energy per year. Europe’s final energy demand in 2050 is estimated to be around 10,000 TWh and 50% would then be covered by electricity from solar and wind. In most scenarios, additional electricity is generated by nuclear and hydropower.

Hydrogen in Europe

Green hydrogen can be produced in electrolysers using renewable electricity, can be transported using the natural gas grid and can be stored in salt caverns and depleted gas fields[8] to cater for seasonal mismatches in supply and demand of energy. It should be noted that blue hydrogen, hydrogen produced from fossil fuels with CCS, can play an important role in an intermediate period, helping kickstart hydrogen as an energy carrier alongside the introduction of green hydrogen.

Using existing gas infrastructure

In Europe the lowest cost renewable resources are hydropower in Norway and the Alps, offshore wind in the North Sea and the Baltic Sea, onshore wind in selected European areas, whereby the best solar resource is in Southern Europe. The current electricity grid was not built for this, is not fit for the energy transition and needs to be drastically modernised. In 2018, an estimated € 1 billion worth of offshore wind energy was curtailed in Germany due to insufficient transmission grid capacity.

In addition, the development of new renewable energy capacity is slowed down due to the lack of grid capacity. Unfortunately, overhead power lines are difficult to realise due to environmental concerns, popular opposition and typically take more than a decade for planning, permitting and construction. However, a gas grid is much more cost-effective than an electricity grid: for the same investment a gas pipe can transport 10-20 times more energy than an electricity cable. Also, Europe has a well-developed gas grid that can be converted to accommodate hydrogen at minimal cost. Recent studies carried out by DNV-GL[9] and KIWA[10] in the Netherlands concluded that the existing gas transmission and distribution infrastructure is suitable for hydrogen with minimal or no modifications.

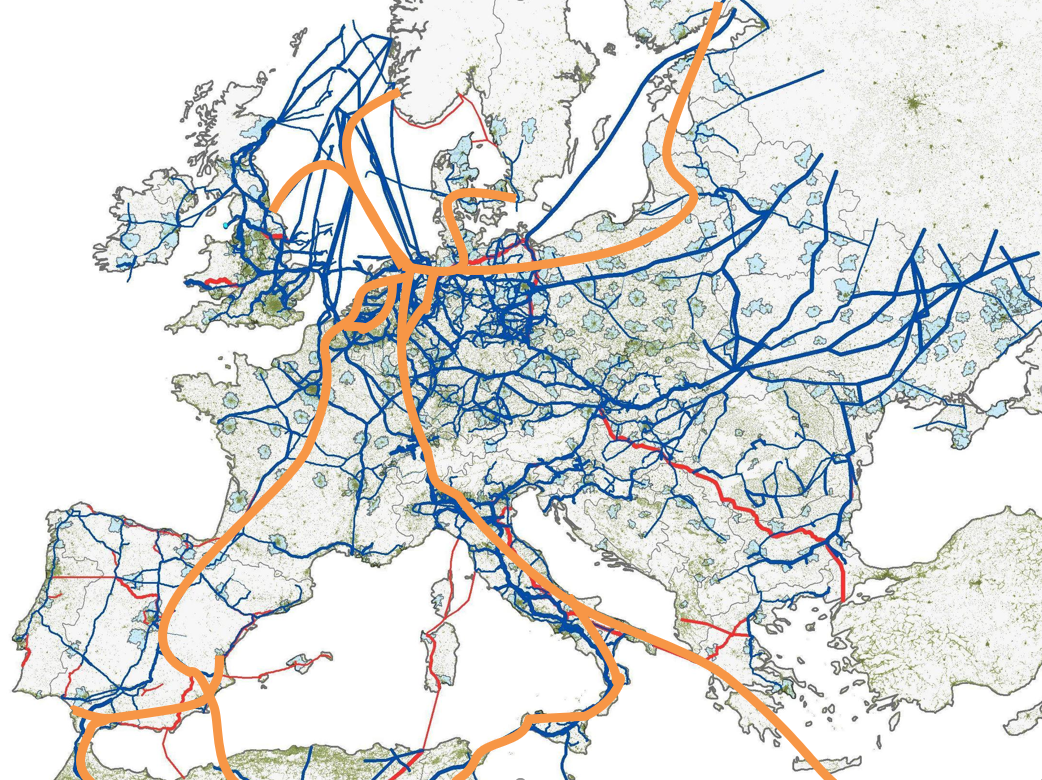

So instead of transporting bulk electricity throughout Europe, a more cost-efficient way would be to transport green hydrogen and have a dual electricity and hydrogen distribution system. Picture 2 shows the existing European natural gas grid (blue) and a hydrogen backbone (orange) as suggested by Hydrogen Europe and Delft University.

Picture 2: Natural gas infrastructure in Europe (blue and red lines) and first outline for a hydrogen backbone infrastructure (orange lines) [Delft University of Technology, Hydrogen Europe, 40GW Electrolyser Initiative]

A different approach: top down, not bottom up

By 2050 when Europe’s electricity system is largely based on variable renewables, hydrogen is indispensable. Several scenarios have tried to estimate the increasing demand for hydrogen in Europe over time and all of them use a bottom-up approach. Although there is merit in this approach by applying industry’s collective knowledge and a deep-dive in these sectors, the fundamental flaw lies in the fact that at present there is no market for green hydrogen, and it is therefore very difficult to estimate e.g. adoption rates for fuel cell vehicles or the willingness among consumers to choose between green gas or all-electric solutions for their domestic energy needs.

A more ambitious approach based on infrastructure development is proposed, similar to the introduction of electricity or natural gas. The fundamental philosophy is to make green hydrogen available at scale and cost-effectively and replace fossil fuels as quickly as possible by repurposing the current natural gas infrastructure to carry green hydrogen. Since the transmission and distribution infrastructure is already to a large extent available, the focus can be on developing electrolyser capacity, which is an opportunity for European market leadership.

How much hydrogen do we need or want?

65% of Europe’s current final energy demand consists of gas, coal and petroleum products, which can all be replaced by hydrogen and electricity. We therefore propose a 50% share of green hydrogen in Europe’s final energy demand for all sectors: industry, transport, commercial and households. Of course, this is a rough estimate and will differ per sector and country. It is doable in the transport sector, achieving a balanced mix of battery electric mobility for shorter distances, combined with fuel cell vehicles for heavy duty, longer ranges and higher convenience.

Most industrial high heat demand, currently served by natural gas, can be provided by hydrogen, and the household sector will consist of a mix of all-electric well-insulated new houses, while a large part of the existing building stock can be heated using hydrogen fuel cells and hydrogen gas boilers. Including the hydrogen required for power system balancing, this represents an overall hydrogen demand of 6,000 TWh/year, which can easily be accommodated by the European natural gas grid.

The green hydrogen will be produced by additional green electricity plants in Europe over and beyond the 2,000 GW solar and 650 GW wind capacity, in addition to blue hydrogenmade from natural gas whilst capturing and storing the CO2. However, 50% of the demand will be imported from neighboring regions in North Africa and the Middle East where green hydrogen can be produced cheaply and transported through cost-effective pipelines. Additional green hydrogen can be imported in liquid or ammonia form from additional sources further away, like LNG nowadays. Europe’s import dependency will be roughly cut in half, and since hydrogen can be produced almost anywhere, the supply risk profile will be much improved.

Cost competitive hydrogen

Renewable electricity is rapidly becoming cheaper than conventional electricity made in nuclear, gas- or coal-fired power plants. If a market would develop along the lines sketched here, hydrogen can be produced at € 1 per kg, which is compatible with natural gas prices of €9/mmbtu. Since the energy content of 1 kg of hydrogen is equivalent to 3.8 litre of gasoline, it is certainly cheaper than gasoline or diesel at that price point. But the main advantage lies in the infrastructure, the proposed transition would to a large extent use the existing natural gas grid and would avoid an expensive and troublesome complete overhaul of the electricity grid.

Action agenda

A European energy system based on 50% green electricity and 50% green hydrogen as described above would have many advantages: reduced emissions, reduced price volatility, industrial opportunity, avoidance of stranding gas grid assets and increased resilience.

The following are necessary considerations for an action agenda:

- A strong, clear and lasting political commitment is necessary, embedded in a binding European strategy with clear goals stretching over several decades.

- A new type of public private partnership on a pan-European level must be crafted, with the aim to create an ecosystem to nurture a European clean energy industry that has the potential to be world leaders in the field. This partnership should include the existing energy industry, as well as innovative newcomers.

- A novel enabling regulatory environment and associated market design is required for the necessary investments, whilst keeping the system costs affordable.

This implies that Europe needs to:

- Develop a common internal market for hydrogen

- Develop an internal market for power to hydrogen, hydrogen to power and storage + flexibility

- Expand the public electricity infrastructure and make it fit for the 21st century

- Convert the public natural gas infrastructure into a public hydrogen infrastructure

- Develop large scale hydrogen storage facilities in salt caverns and depleted gas fields

- Expand large scale green electricity production through national and EU auctions for renewable electricity

- Stimulate large scale green hydrogen production through national and EU auctions for renewable hydrogen

- Until 2035: stimulate large scale blue hydrogen (hydrogen made from fossil fuels whereby the CO2 is captured and permanently stored) production through national and EU auctions in parallel to green hydrogen deployment

- Between 2035 and 2050: switch rapidly to a system 100% based on renewable electricity and green hydrogen.

- Develop a modern, innovative, competitive and world leading economy on green electricity and green hydrogen as energy carriers and feedstock.

***

Frank Wouters is a former Deputy Director-General at IRENA. For a full CV click here.

Prof. Dr. Ad van Wijk is sustainable energy entrepreneur and part-time Professor Future Energy Systems at TU Delft, the Netherlands. For a full CV click here.

This article originally appeared at: https://energypost.eu/50-hydrogen-for-europe-a-manifesto/

CITATIONS:

- https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2019.pdf ↑

- https://www.shell.com/energy-and-innovation/the-energy-future/scenarios/shell-scenario-sky.html ↑

- https://fch.europa.eu/sites/default/files/Hydrogen%20Roadmap%20Europe_Report.pdf ↑

- https://eto.dnvgl.com/2018/ ↑

- http://energywatchgroup.org/wp-content/uploads/2017/11/Full-Study-100-Renewable-Energy-Worldwide-Power-Sector.pdf ↑

- http://www.ewea.org/fileadmin/files/library/publications/position-papers/EWEA_2050_50_wind_energy.pdf ↑

- http://files.gwec.net/register?file=/files/GlobalWindEnergyOutlook2016 ↑

- https://forschung-energiespeicher.info/wind-zu-wasserstoff/projektliste/projekt-einzelansicht/74/Wasserstoff_unter_Tage_speichern/ (in German) ↑

- https://www.topsectorenergie.nl/sites/default/files/uploads/TKI%20Gas/publicaties/DNVGL%20rapport%20verkenning%20waterstofinfrastructuur_rev2.pdf(in Dutch) ↑

- KIWA – Toekomstbestendige gasdistributienetten – GT170227 (July 2018 – in Dutch) ↑